Phillips 66: IMO 2020 Will Likely Lead To Surge In Refining Profits

by Michael FitzsimmonsSummary

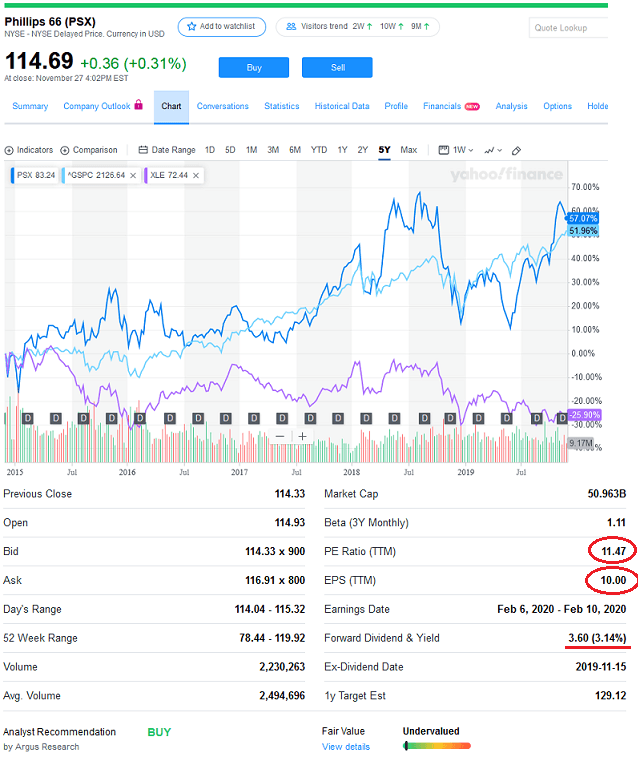

- Over the past five years, PSX has not only outperformed the broad energy sector, but has also beaten the S&P 500.

- Still, the company's P/E is less than half that of the broad S&P 500, while the dividend yield is over 1% higher.

- Due to the IMO 2020 mandate, diesel crack margins futures for 2020 are currently ~$4/bbl higher than the historical average.

- Every $1 increase in diesel crack margins translates into ~$300 million in incremental EBITDA for PSX.

- I reiterate my BUY rating on PSX and raise my 2020 price target by $10 to $130. Investors should consider PSX as a core long-term holding.

Phillips 66 (PSX) is one of the very few energy stocks that have thrived over the past decade as the broad energy sector has severely under-performed the S&P 500. In fact, over the past five years, PSX has even outperformed the S&P 500:

Source: Yahoo Finance

While that might surprise some investors, the only surprise to me is that PSX didn't outperform the S&P 500 by significantly more than only ~5%. That's because Phillips 66's valuation metrics compare very favorably with those of the broad S&P 500:

By these metrics, PSX still looks significantly undervalued. And as I explained in my last Seeking Alpha article on the company, this comes at a time when PSX is diversifying away from the cyclical refining segment and more toward the steady full-cycle "toll-like" earnings from midstream pipelines. A prime example is the 900,000 bpd Gray Oak pipeline from the Permian and Eagle Ford shale plays to the Gulf Coast - which recently started line fill.

As I said way back in 2013, Phillips 66 May Be The Best Play On Domestic Shale because - as a downstream company - the company is in a better position to benefit from growing US petroleum production than many of the producers themselves. Phillips 66's proven long-term track record of earnings and dividend certainly differentiates it from the broad energy sector. Meantime, an emerging catalyst - IMO 2020 - does not yet appear to be priced into next year's earnings potential.

IMO 2020

Heading into next year, a powerful tailwind for Phillips 66's refining segment is the clean-energy IMO 2020 global initiative to reduce sulfur emissions in the marine sector by ~85% by switching to lower sulfur fuels starting January 1, 2020.

Phillips 66 can capitalize on this market-changing event in multiple ways:

- By using its existing global footprint to maximize returns

- By optimizing logistics for its refining feedstock

- By leveraging the largest coking capacity in the industry and providing distillate production for bunker fuel blending

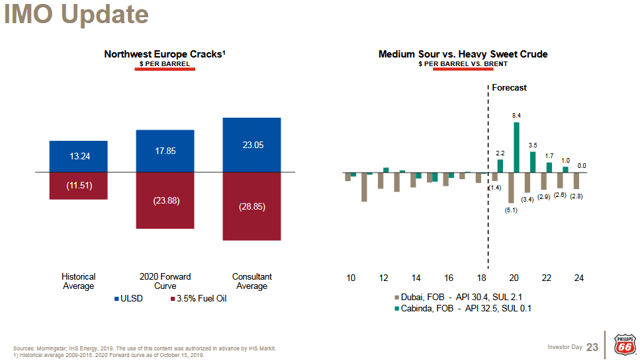

Source: Phillips 66 Investor Day Presentation

As the graphic above shows, the diesel crack has averaged about $13/bbl over the last 10 years. The current 2020 futures forecast for ULSD (ultra-low sulfur diesel) indicates a crack about $4.50/bbl higher - or almost $18/bbl for 2020. Now, according to management comments in the recent Investor Day presentation transcript, this is a powerful catalyst for PSX:

Every $1 per barrel change in the diesel crack is about $300 million a year of incremental EBITDA for our Refining segment:

So, for example, let's say that the diesel crack next year averages only $16/bbl for the full year. That's still ~$2.75/bbl higher than the historical norm and would therefore equate to an estimated $825 million of incremental EBITDA for the company. Since PSX has reduced its outstanding share count by over 30% since its 2012 IPO, the $825 million of incremental EBITDA equates to an estimated $1.85/share (based on 444 million shares outstanding at the end of Q3). That's huge considering the company's last 12 months' earnings were $10.00/share.

In addition, the graphic also shows that 2020 forward prices for high-sulfur (i.e. "3.5% Fuel Oil") fuel oil discounts have expanded recently to about $24/bbl. This compares to roughly $12/bbl historically. Consultants believe the discount will widen further as the world works to dispose of excess high-sulfur diesel. PSX expects high-sulfur fuel oil to contribute to wider differentials on heavy sour crudes and every dollar per barrel change in heavy sour discounts is worth $250 million a year in EBITDA for the company.

The 2020 forward curve for Canadian heavy is currently about $17.50/bbl. Year-to-date 2019 heavy sour discounts for Canadian have averaged about $12.50/bbl. That implies an estimated $5/bbl increase expected in the forward curve for next year, or an estimated $1.25 billion in incremental EBITDA for PSX.

Summary & Conclusion

PSX is now the premier integrated energy logistics company in the US. It has diversified away from refining by heavily investing in midstream and chemicals. That said, its refining segment is likely to be in the spotlight next year due to the implementation of the 2020 IMO clean-fuel mandate. While there will likely be some market disruptions while implementing the new standards, it is clear that diesel crack margins are heading higher and PSX is in an excellent position to capitalize on them.

As shown in the article, the current futures curves indicate estimated incremental EBITDA of an estimated ~$2 billion due to the combination of higher prices for ULSD fuel and lower prices for Canadian heavy feedstock. That's over $4/share of incremental EBITDA ... so even if the estimates are off by 50%, it's still over $2/share of incremental EBITDA growth in the refining segment as compared to this year (all else being equal).

I repeat my BUY rating on PSX and raise my 2020 price target to $130 based on higher refining margins. PSX has established itself as one of the best dividend growth stocks in the entire S&P 500 (a 25% CAGR since the IPO), and that is likely to continue for many years to come. In addition - as shown earlier - PSX is currently a bargain in comparison to the broad S&P 500 in terms of both its relatively low P/E ratio and relatively high dividend yield.

Disclosure: I am/we are long PSX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.