Vanguard International Dividend Appreciation ETF: Exposure To High-Quality Foreign Stocks

by BOOX ResearchSummary

- VIGI screens for non-U.S. stocks with at least a seven-year consecutive history of increasing the dividend amount.

- Fund has outperformed some other widely traded foreign stock ETFs in recent years.

- VIGI is a good choice to gain exposure to a group of high-quality foreign stocks.

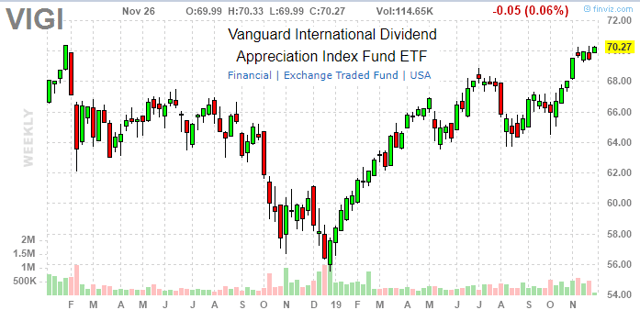

The Vanguard International Dividend Appreciation ETF (NYSE:VIGI) with $1.6 billion in total assets tracks a basket of non-U.S. equities with a history of dividend growth. The fund's top holdings include a number of high-quality multinational firms which are recognized for their respective market leadership position and solid financial profile. We like the strategy here and concept of the fund which make it well positioned to benefit from global macro trends and is a good choice for investors seeking diversification into foreign stocks. VIGI is up 23% year to date, in line with the strong equity market performance globally this year, while we highlight some favorable risk metrics including a lower beta relative to the S&P 500 (SPY). This article provides some background on the fund along with our view on where VIGI is headed next and the key factors to watch for investors.

(Source: FinViz.com)

Fund Background

The Vanguard ETF is based on the "NASDAQ International Dividend Achievers Select Index" with a full replication strategy. The index itself is market cap weighted and comprised of stocks with at least seven consecutive years of increasing annual regular dividend payments. Keep in mind these companies typically declare the payouts in foreign currency and the per share dollar value of the dividend will depend on the current exchange rate. In this case some foreign currencies are more volatile than others, but investors need to be aware that FX represents one of the main risks when investing in foreign stocks and an ETF like VIGI.

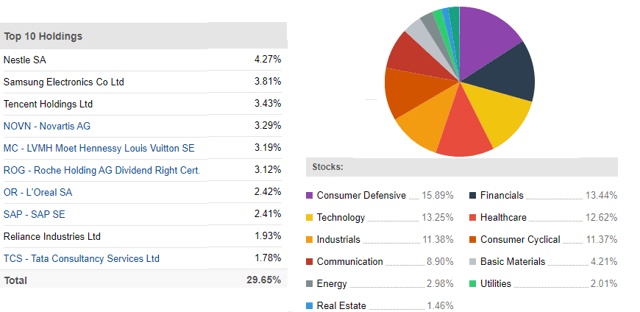

Across 399 equity holdings, the fund is well diversified with Consumer Defensive at 15.9% as the most well represented sector. The sector breakdown is consistent with the types of companies that are prone to regularly increase their dividend and meet the inclusion criteria. Notably, VIGI has a relatively low exposure to Energy and Materials sectors which together comprise about 7.3% of the fund.

(Source: Seeking Alpha Premium)

Performance

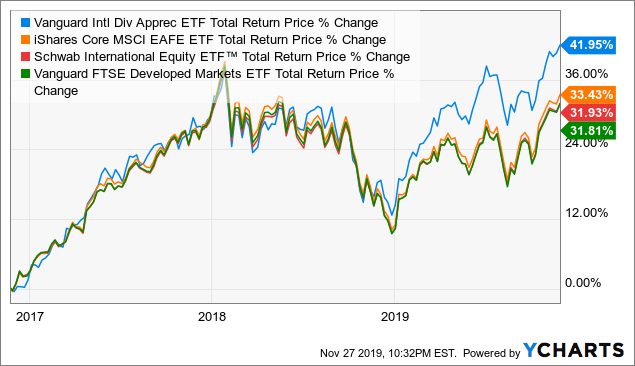

While VIGI does not have a stated benchmark, we include the iShares Core MSCI EAFE ETF (IEFA), the Schwab International Equity ETF (SCHF), along with the Vanguard FTSE Developed Markets ETF (VEA) for comparison purposes. VEA specifically is an interesting comparable since it's from the same fund family at Vanguard and includes many of the same holdings. VEA is one of the largest "foreign stock" ETFs in the market by AUM at $76 billion. Favorably, VIGI is up 42% over the past three years which has outperformed IEFA, SCHF, and VEA over the period.

Data by YCharts

VIGI has outperformed the group in 2019 with its focus on dividend growth, tilting towards "higher quality" names, which the market has rewarded over the period on concerns regarding global growth conditions this year. In this regard, VIGI has also benefited from its low exposure to the energy sector which represents just 3% of the fund. It's likely in future periods, stronger momentum in the energy sector would result in VIGI trailing this peer group. Nevertheless, recognizing the limited performance history given VIGI's inception in 2016, we think the fund is worthy of consideration as a core holding for foreign stock exposure.

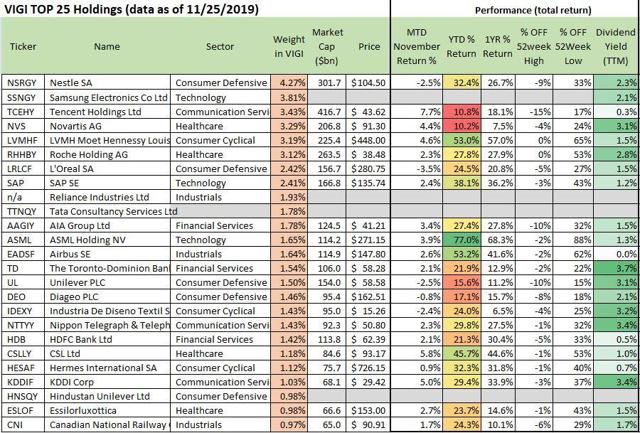

Underlying Holdings

Nestle SA (OTCPK:OTCPK:NSRGY) with a 4.27% weighting in the fund is the target holding and the stock has returned 32.4% in 2019 on a total return basis. Netherlands-based chip stock ASML Holding NV (NASDAQ:ASML) with a 1.65% weighting in the fund is the best performer among the top holdings this year, up 77%.

(Source: data by YCharts/table by author)

While most of the holdings presented below within the top 25 have either an ADR or over-the-counter share issuance traded on a U.S. exchange, we note that some are relatively liquid. Across the entire 399 equity holdings portfolio, one of the positives of the fund is the exposure to a number of foreign stocks not otherwise easily available for trading for U.S. based retail investors.

Risk Metrics

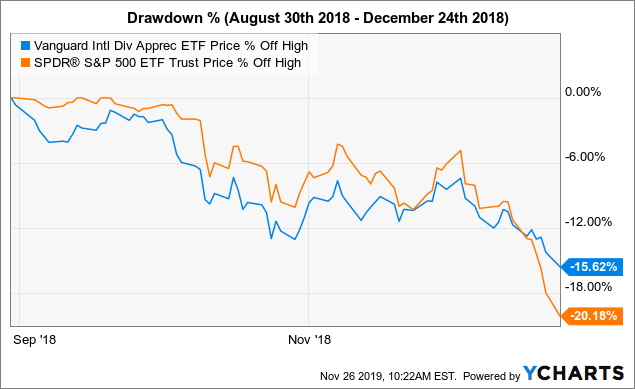

Despite a limited fund performance history given VIGI's inception date of February 2016, extreme volatility during Q4 of last year serves as a good reference for how VIGI would trade during a period of market stress. As a recap, growing uncertainty over global growth in combination with market apprehension over the pace of Fed rate hikes in the second half of 2018 resulted in the S&P 500 falling to approach a new bear market condition, down about 20% from its highs to the low in December. Favorably, VIGI had a smaller drawdown over the period, declining by a more moderate 15.6% compared to 20.2% in the S&P 500.

Data by YCharts

The fund's high weighting towards consumer defensive stocks helps limit volatility which corresponds to the fund's lower beta at 0.84, suggesting relatively less risk than the S&P 500. Again, while the performance history of the fund isn't long enough to draw clear conclusions on its risk profile, we like the way it traded over the period of market stress in late 2018.

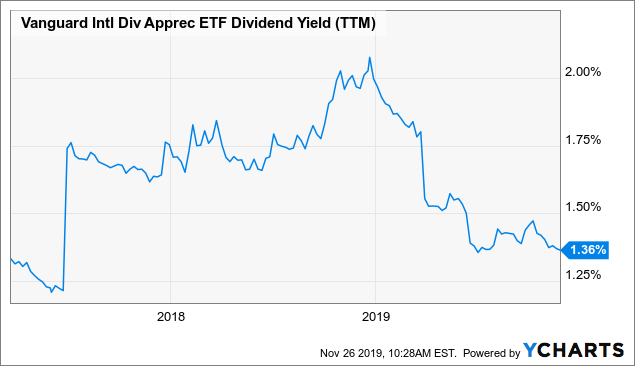

Dividend

For a fund that features the "dividend" in the fund name, the yield here at 1.36% is relatively modest. The value of the fund here is really the collection of high-quality names with at least an expectation of dividend growth even if the underlying yield is not necessarily impressive. Considering the performance of the fund over the past year, it's evident that capital appreciation and upside in the share price of VIGI are more of an attraction beyond the income profile.

Data by YCharts

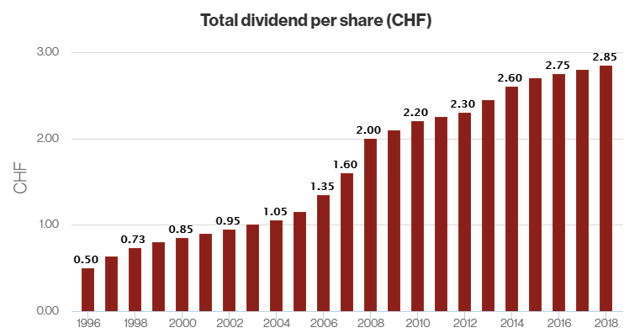

The focus on stocks with a dividend growth profile naturally carries companies with a strong earnings profile. We highlight Novartis AG (NYSE:NVS), the Swiss-based healthcare giant, is the fourth largest holding in VIGI with a 3.3% weighting. The company has 22-year history of continuously increasing the dividend rate on an annual basis going back to 1996. This year the company increased its dividend rate by 2% to CHF2.85 per share, which was paid back in March. Nestle SA is another example of a top holding in the fund with a long history of dividend growth.

(Novartis AG Dividend History. Source: Company IR)

Analysis and Forward-Looking Commentary

With the portfolio of foreign stocks in VIGI, trends in the U.S. dollar continue to be an important monitoring point. Going back to the period around 2014, there was a surge in the dollar through 2015 as the U.S. economy began to outperform global growth and there was an anticipation of rate hikes by the Fed that year. Looking at the chart below of the "U.S. Dollar Index" which tracks a basket of foreign currencies, the dollar has traded in a relatively tight range going back to 2016. This current environment of stability in the dollar particularly against developed market currencies is a positive for VIGI which would also benefit from a clear trend of the dollar weakening (and appreciation of foreign currencies) going forward. Global economic growth conditions and trends in the U.S. dollar represent the main monitoring points for the fund.

(Source: Finviz.com)

Takeaway

We think VIGI is one of the best ETFs to gain exposure to developed market foreign stocks with a solid financial profile. In many ways, the concept of screening for companies that have raised the dividend for at least seven consecutive years is a great screening tool for quality and we expect the fund to perform relatively well on a risk-adjusted basis over all market cycles.

We think VIGI is worthy for consideration as a core holding within a diversified portfolio for exposure to this market segment. While "dividend" is part of the fund name, the opportunity here is capital appreciation, and without making a call on near-term direction, we rate shares of VIGI as a hold. Take a look at the fund's prospectus for a full list of risks and disclosures.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.