Bonanza Creek Energy: Strong Operational Performance Adds To Its Value

by Elephant AnalyticsSummary

- Bonanza Creek has delivered at the high end of production expectations while spending towards the lower end of its original capex budget.

- Production growth may be lower in 2020 as it attempts to minimize cash burn.

- Rapid 2019 production growth has led to a higher base decline rate for now, but this should moderate going forward.

- Leverage remains at low levels and Bonanza Creek appears undervalued by various metrics.

Bonanza Creek (BCEI) has performed well operationally in 2019, raising the midpoint of its full-year production guidance for the second time, while coming in towards the lower end of its original capex budget. The strong production also has contributed to lower per BOE costs.

For 2020, it now appears that Bonanza Creek will aim for lower production growth in order to minimize cash burn. This should help its base decline rate moderate as well as keep its leverage at low levels.

Strong Production

Bonanza Creek narrowed its full-year production guidance to the top part of its guidance range again. It now expects to average 23,000 to 24,000 BOEPD in 2019. This is up (based on guidance midpoint) from the 22,000 to 24,000 BOEPD it expected after Q2 2019, which was already up from its 20,000 to 24,000 BOEPD original guidance.

The strong production performance has allowed Bonanza Creek to trim its lease operating expense guidance to $2.75 to $3.10 per BOE, from the Q2 2019 estimate of $2.75 to $3.25 per BOE (and that too was down from the initial guidance of $3.00 to $3.50 per BOE). The higher production levels bring Bonanza Creek's cash G&A per BOE levels down too.

Bonanza Creek has achieved stronger than expected production with slightly less capex as well. It now expects 2019 capex to be around $230 million to $240 million, instead of its original guidance for $230 million to $255 million.

Bonanza Creek's oil percentage did drop to 57% in Q3 2019, but it expects its oil percentage to fluctuate from the high 50s to low 60s depending on how many wells get turned to sales in a particular quarter.

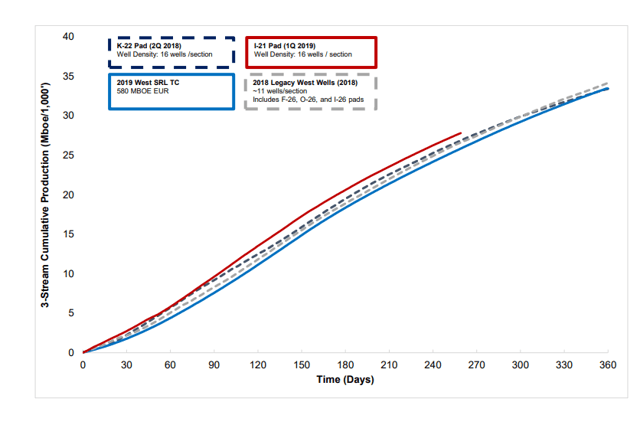

Bonanza Creek's well-level results have been holding up well over time. The latest update shows its I-21 pad wells continuing to track above type curve after eight months with a 16 wells per section density. Combined with service cost reductions, this allows Bonanza Creek's wells to generate good returns in the current commodity pricing environment.

Source: Bonanza Creek

2020 Outlook

Bonanza Creek still expects to grow production in 2020, but appears to be aiming for a one-rig program through most of the year now. It previously was contemplating running 1.5 rigs in 2020.

I now project Bonanza Creek to average around 25,000 BOEPD (60% oil) in 2020, which would be around 6% production growth compared to 2019 now, although this would be 14% production growth compared to Bonanza's original 2019 production expectations.

Bonanza Creek would then generate around $326 million in revenues at current strip prices (including $56 to $57 WTI oil).

| Type | Units | $/Unit | $ Million |

| Oil (Barrels) | 5,475,000 | $52.50 | $287 |

| NGLs (Barrels) | 1,460,000 | $9.00 | $13 |

| Natural Gas [MCF] | 13,140,000 | $2.00 | $26 |

| Total Revenue | $326 |

Bonanza Creek's cash expenditures would be around $349 million, leading to a projection of $23 million in cash burn in 2020. Bonanza Creek would be fairly close to neutral cash flow, with the base decline rate caused by its rapid 2019 production growth (it was producing less than 18,000 BOEPD in Q4 2018) potentially keeping it from positive cash flow for now.

| Expenses | $ Million |

| Lease Operating Expense | $28 |

| RMI (Midstream) Expenses | $12 |

| Gathering, Transportation and Processing | $18 |

| Production Taxes | $28 |

| Cash G&A | $33 |

| Cash Interest | $5 |

| CapEx | $225 |

| Total Expenses | $349 |

Bonanza Creek's leverage is expected to remain at a low 0.6x multiple by the end of 2020.

Valuation

Bonanza Creek noted that it had a PDP PV-10 of $546 million at strip prices in mid-2019. Bonanza's enterprise value (using Q2 2019 debt levels and its current share price) is around $426 million, meaning that it is trading for around 0.78x PDP PV-10 at strip prices that are marginally higher than current strip. This is a fairly low valuation given the development potential of Bonanza Creek's assets.

Based on year-end 2020 projected debt levels, Bonanza Creek is valued at only 2.4x its projected 2020 EBITDAX. Both metrics above suggest that Bonanza Creek is undervalued.

Conclusion

Bonanza Creek has delivered production at the high end of expectations for 2019, while keeping capex towards the lower end of its original budget. Its wells appear to generate solid returns at current prices as well. Going forward, Bonanza Creek is likely to aim for modest production growth in 2020 combined with a limited amount of cash burn. This could set it up for stronger production growth in 2021 (without cash burn) as its base decline rate moderates.

Bonanza Creek has a low amount of leverage and appears undervalued by various metrics and I would consider sub-$18 as a pretty good price for it.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BCEI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.